Sales Tax On Cars In Orange County Florida . If you are not in. Sales tax credit may be allowed for sales tax paid in another state. under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. to calculate the sales tax for a car purchase in florida, one needs to add the statewide sales tax rate, which is 6%,. The florida department of revenue will always have the current sales tax rate listed. this page covers the most important aspects of florida's sales tax with respects to vehicle purchases. what is florida's sales tax for cars? the sales tax rate in the state of florida is 6%. Florida collects a six percent sales tax on the purchase of all new or used vehicles. Other exemptions may apply for divorce proceedings, inheritance, adding florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,.

from mungfali.com

Florida collects a six percent sales tax on the purchase of all new or used vehicles. the sales tax rate in the state of florida is 6%. this page covers the most important aspects of florida's sales tax with respects to vehicle purchases. If you are not in. what is florida's sales tax for cars? The florida department of revenue will always have the current sales tax rate listed. Other exemptions may apply for divorce proceedings, inheritance, adding florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,. under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. to calculate the sales tax for a car purchase in florida, one needs to add the statewide sales tax rate, which is 6%,.

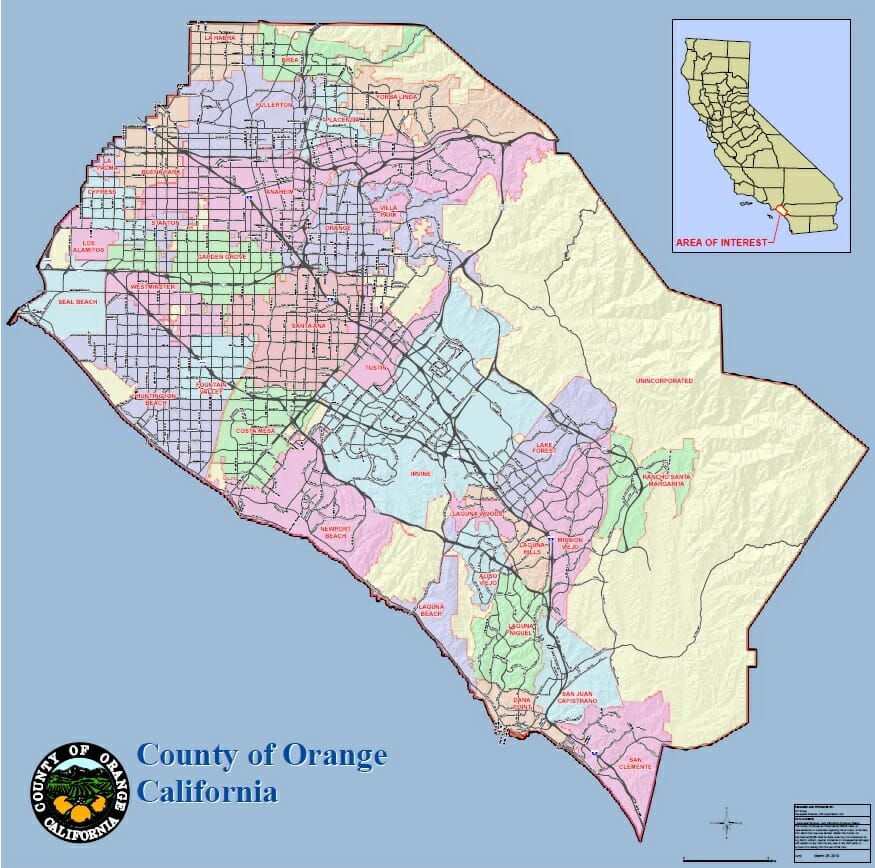

Orange County Florida Boundary Map

Sales Tax On Cars In Orange County Florida Sales tax credit may be allowed for sales tax paid in another state. Florida collects a six percent sales tax on the purchase of all new or used vehicles. to calculate the sales tax for a car purchase in florida, one needs to add the statewide sales tax rate, which is 6%,. what is florida's sales tax for cars? Sales tax credit may be allowed for sales tax paid in another state. the sales tax rate in the state of florida is 6%. florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,. Other exemptions may apply for divorce proceedings, inheritance, adding If you are not in. under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. this page covers the most important aspects of florida's sales tax with respects to vehicle purchases. The florida department of revenue will always have the current sales tax rate listed.

From www.yelp.com

ORANGE COUNTY TAX COLLECTOR 17 Photos & 42 Reviews 301 S Rosalind Sales Tax On Cars In Orange County Florida The florida department of revenue will always have the current sales tax rate listed. this page covers the most important aspects of florida's sales tax with respects to vehicle purchases. Sales tax credit may be allowed for sales tax paid in another state. what is florida's sales tax for cars? florida sales and use tax, plus any. Sales Tax On Cars In Orange County Florida.

From www.yelp.com

Orange County Tax Collector Downtown Office Tax Services Orlando Sales Tax On Cars In Orange County Florida under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,. Florida collects a six percent sales tax on the purchase of all new or used vehicles. to. Sales Tax On Cars In Orange County Florida.

From mungfali.com

Orange County Florida Boundary Map Sales Tax On Cars In Orange County Florida the sales tax rate in the state of florida is 6%. this page covers the most important aspects of florida's sales tax with respects to vehicle purchases. The florida department of revenue will always have the current sales tax rate listed. under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which. Sales Tax On Cars In Orange County Florida.

From salestaxhelper.com

Florida Sales Tax Guide for Businesses Sales Tax On Cars In Orange County Florida florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,. Florida collects a six percent sales tax on the purchase of all new or used vehicles. If you are not in. to calculate the sales tax for a car purchase in florida, one needs to add. Sales Tax On Cars In Orange County Florida.

From www.slideshare.net

Used Cars For Sale in Orange County Sales Tax On Cars In Orange County Florida The florida department of revenue will always have the current sales tax rate listed. the sales tax rate in the state of florida is 6%. under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. Florida collects a six percent sales tax on the purchase of all new or used. Sales Tax On Cars In Orange County Florida.

From www.templateroller.com

Orange County, Florida Sparklers Retail Sales Permit Application Fill Sales Tax On Cars In Orange County Florida Sales tax credit may be allowed for sales tax paid in another state. If you are not in. what is florida's sales tax for cars? under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. Florida collects a six percent sales tax on the purchase of all new or used. Sales Tax On Cars In Orange County Florida.

From octaxcol.com

Save Our Homes Orange County Tax Collector Sales Tax On Cars In Orange County Florida florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,. under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. Florida collects a six percent sales tax on the purchase of all new or used vehicles. the. Sales Tax On Cars In Orange County Florida.

From www.youtube.com

Our Incredible You Pick'Em Offer is Back! Come See the Best Car Leases Sales Tax On Cars In Orange County Florida Sales tax credit may be allowed for sales tax paid in another state. florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,. the sales tax rate in the state of florida is 6%. to calculate the sales tax for a car purchase in florida,. Sales Tax On Cars In Orange County Florida.

From www.templateroller.com

Orange County, Florida Business Tax Receipt Zoning Approval Form Sales Tax On Cars In Orange County Florida under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. Sales tax credit may be allowed for sales tax paid in another state. what is florida's sales tax for cars? to calculate the sales tax for a car purchase in florida, one needs to add the statewide sales tax. Sales Tax On Cars In Orange County Florida.

From www.octaxcol.com

Orange County Florida Tax Collector Office Scott Randolph Sales Tax On Cars In Orange County Florida The florida department of revenue will always have the current sales tax rate listed. If you are not in. this page covers the most important aspects of florida's sales tax with respects to vehicle purchases. Florida collects a six percent sales tax on the purchase of all new or used vehicles. to calculate the sales tax for a. Sales Tax On Cars In Orange County Florida.

From www.ocrealestateinc.com

Orange County Market Report Sales Tax On Cars In Orange County Florida If you are not in. The florida department of revenue will always have the current sales tax rate listed. what is florida's sales tax for cars? Other exemptions may apply for divorce proceedings, inheritance, adding the sales tax rate in the state of florida is 6%. to calculate the sales tax for a car purchase in florida,. Sales Tax On Cars In Orange County Florida.

From www.pdffiller.com

Fillable Online Orange County Florida Property Tax Exemptions. Orange Sales Tax On Cars In Orange County Florida If you are not in. what is florida's sales tax for cars? Other exemptions may apply for divorce proceedings, inheritance, adding florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,. under florida state law, the florida department of revenue collects 6% sales tax on. Sales Tax On Cars In Orange County Florida.

From www.orangeleader.com

Sales tax down for most of Orange County Orange Leader Orange Leader Sales Tax On Cars In Orange County Florida Other exemptions may apply for divorce proceedings, inheritance, adding the sales tax rate in the state of florida is 6%. what is florida's sales tax for cars? under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. If you are not in. The florida department of revenue will always. Sales Tax On Cars In Orange County Florida.

From www.facebook.com

Cash for Cars We Buy Cars Orange County California Sales Tax On Cars In Orange County Florida If you are not in. Florida collects a six percent sales tax on the purchase of all new or used vehicles. this page covers the most important aspects of florida's sales tax with respects to vehicle purchases. what is florida's sales tax for cars? Other exemptions may apply for divorce proceedings, inheritance, adding the sales tax rate. Sales Tax On Cars In Orange County Florida.

From tipseri.com

How do I find my deeds in Orange County Florida? Tipseri Sales Tax On Cars In Orange County Florida florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,. under florida state law, the florida department of revenue collects 6% sales tax on $28,000, which is the. to calculate the sales tax for a car purchase in florida, one needs to add the statewide. Sales Tax On Cars In Orange County Florida.

From orangefl.mugshots.zone

ATKINS ANTONIO 04/04/2023 Orange County Mugshots Zone Sales Tax On Cars In Orange County Florida Sales tax credit may be allowed for sales tax paid in another state. to calculate the sales tax for a car purchase in florida, one needs to add the statewide sales tax rate, which is 6%,. this page covers the most important aspects of florida's sales tax with respects to vehicle purchases. If you are not in. . Sales Tax On Cars In Orange County Florida.

From www.yelp.ca

Orange County Tax Collector 16 Reviews Ministry of Transportation Sales Tax On Cars In Orange County Florida Florida collects a six percent sales tax on the purchase of all new or used vehicles. to calculate the sales tax for a car purchase in florida, one needs to add the statewide sales tax rate, which is 6%,. the sales tax rate in the state of florida is 6%. Other exemptions may apply for divorce proceedings, inheritance,. Sales Tax On Cars In Orange County Florida.

From www.whereig.com

Orange County Map, Florida, USA Cities, Population, Facts, Where is Sales Tax On Cars In Orange County Florida florida sales and use tax, plus any applicable discretionary sales surtax, is due on all new or used motor vehicles sold, leased,. the sales tax rate in the state of florida is 6%. Sales tax credit may be allowed for sales tax paid in another state. If you are not in. what is florida's sales tax for. Sales Tax On Cars In Orange County Florida.